Morningstar Analysts 28022014 The Morningstar Categories for funds in the Malaysia Private Retirement Scheme universe were first established shortly after the. The eight 8 available PRS Providers are.

A Guide To The Private Retirement Scheme Prs

Find out what are the best Malaysian Private Retirement Schemes PRS to invest in in 20202021.

. As a starting reference point last year the EPF suggested that an elderly couple living in the Klang Valley would need at least RM3090 a month to achieve a reasonable standard of living. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. Ad The 10 best places to retire overseas in 2022.

There are two broad categories of retirement funds Core Funds and Non-Core Funds. We offer nine PRS funds to suit your needs. PRS seek to enhance choices available for.

The Employee Provident Fund EPF the national compulsory saving scheme for individuals employed in the Malaysian private sector is based on the Employees Provident. In the Core Conservative category AmPRS Conservative Fund is the best performing fund as it has the highest Sharpe ratio and 5-year annualised return. At present there are eight PRS providers which include Affin Hwang AM AIA AmInvest CIMB-Principal Kenanga Investors Manulife AM Public Mutual and RHB AM.

For starters PRS is a voluntary contribution scheme where you can contribute as little or as much as you want. The PRS was launched in July 2012 with the objective of offering Malaysian employees and the self. Let Public Mutual help optimise your retirement savings via PRS Public Mutual is one of the approved PRS providers.

Thats the money you need when you hit 5560 years old depending on. The Private Retirement Schemes are offered by PRS Providers who are approved by the Securities Commission Malaysia. Secondly PRS is privately run by financial institutions with no.

The 10 best overseas retirement and lifestyle havens for 2022. Differences between Private Retirement Scheme PRS and. PRS or Private Retirement Scheme is another place to park and grow your retirement savings.

Save invest and retire wellPrivate Retirement Schemes Quick Overview. Private Retirement Scheme PRS is a voluntary scheme that lets you take the lead on boosting your total retirement savings. If yes you may want to consider investing in a Private Retirement Scheme PRS.

Malaysia My Second Home Programme MM2H is an initiative taken by the. For public employees there is the Kumpulan Wang Persaraan Diperbadankan or KWAP Malaysia which focuses on managing retirement and pension funds for civil servants. Differences between Private Retirement Scheme PRS and Deferred Annuity.

PRS Providers Schemes. One of the main reasons why Malaysia is the best place for retirees is its excellent government schemes. Conventional or Islamic private retirement schemes.

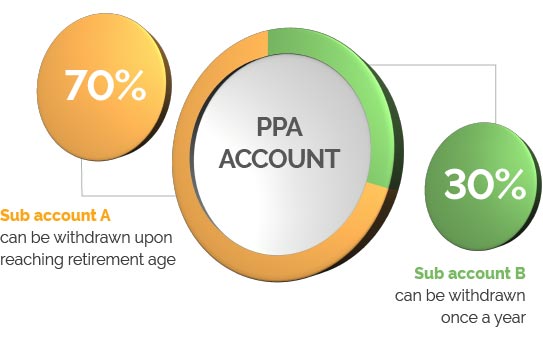

Fast facts about the Private Retirement Scheme PRS A voluntary scheme for all individuals who are 18 years old and above A way to boost your total retirement. Core Funds Each provider must offer 3 core funds as a default option for PRS.

What S The Difference Of Private Retirement Scheme And Deferred Annuity Plan Kclau Com

Prs Faq Private Pension Administrator Malaysia Ppa

Private Retirement Scheme Principal Asset Management

Ppa S Fees And Charges Private Pension Administrator Malaysia Ppa

Beginner S Guide To Private Retirement Schemes Prs In Malaysia

Best Places To Retire In 2022 The Annual Global Retirement Index

Which Prs Funds To Invest In 2020 2021 Mypf My

Private Retirement Scheme Principal Asset Management

Retirement Benefits Services Pwc

Improving The Design Of Retirement Saving Pension Plans Oecd

Private Retirement Scheme Principal Asset Management

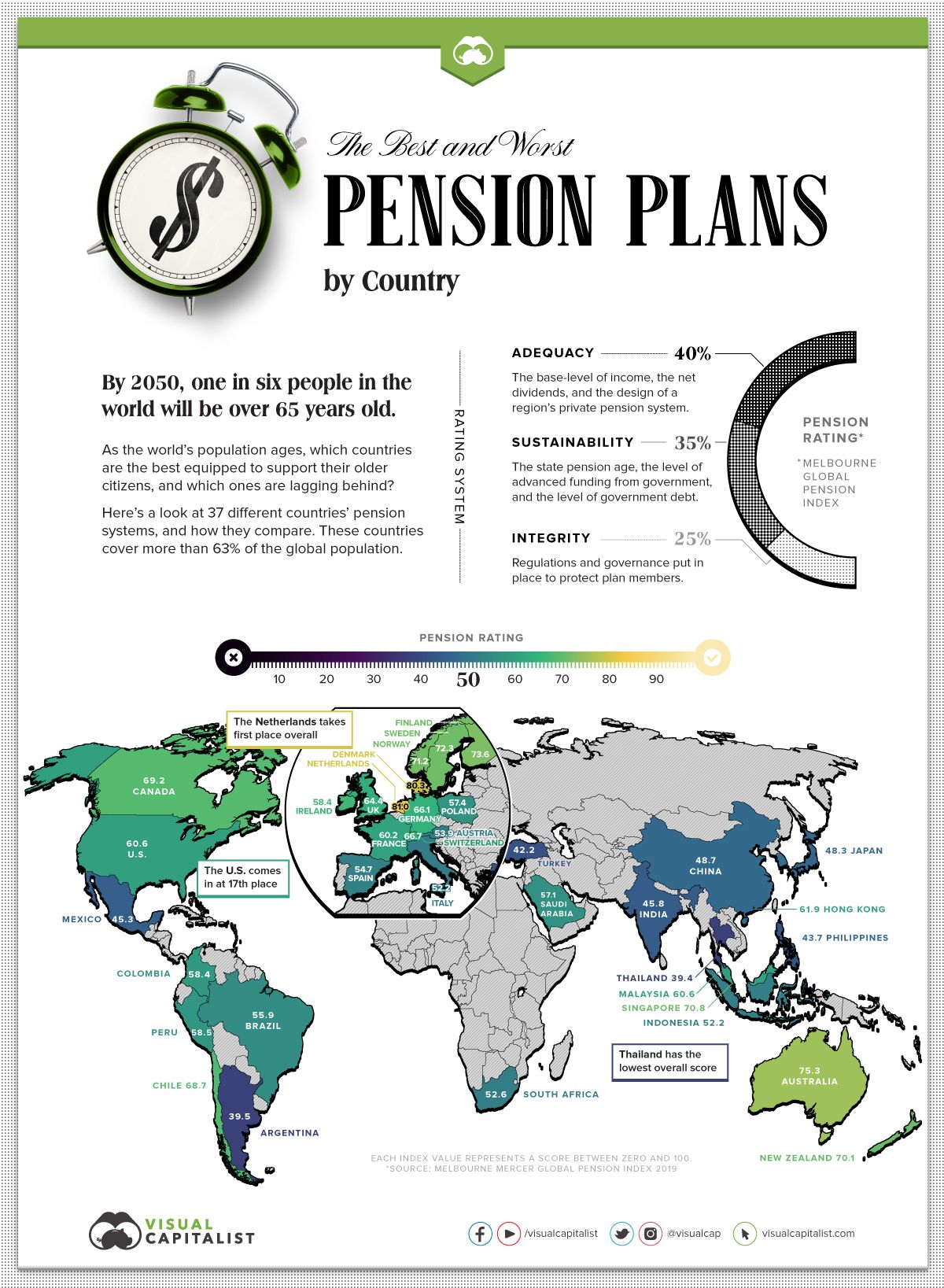

Ranked Countries With The Best And Worst Pension Plans

How To Choose The Best Private Retirement Scheme Malaysia

Global Investor 100 Top Private Equity Investors Private Equity International

A Guide To The Private Retirement Scheme Prs

Cover Story Is Prs Outperforming Epf The Edge Markets

Prs Faq Private Pension Administrator Malaysia Ppa

Ppa S Fees And Charges Private Pension Administrator Malaysia Ppa

The 18 Best Financial Advisors In Malaysia 2022